MasterTrader – Master Trader Option Strategies

MasterTrader – Master Trader Option Strategies course is now available at an affordable price. You can check out directly using multiple payment gateway options. If you have any questions or need an alternative payment method, feel free to contact us.

Description

MasterTrader – Master Trader Option Strategies

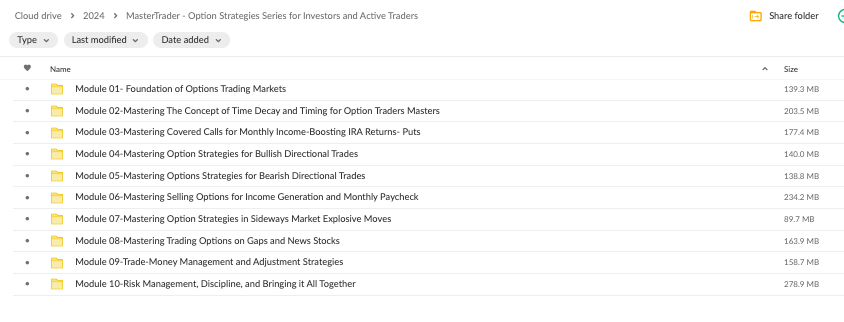

Below are the 10 Modules for this Option Strategies Series, which have been artfully created to take you on an educational Journey to Option Trading Mastery!

I. Foundation of Options Trading and Markets

Introduction to Options

Call and Put Options and When Used

Understanding Option Terminology and Quote Screen

Using Technical Analysis With Option Trading

III. Mastering Covered Calls for Monthly Income and Boosting Returns

Covered Calls Defined and Risk Graph

Buying Covered Calls as Mildly Bullish Directional Trade

Selling Calls Against Holdings for Income

Selling Calls Against Holdings to Reduce Cost Basis

Selecting Optimal Strike and Expiration

Buying Covered Puts as Mildly Bearish Directional Trade

V. Option Strategies for Bearish Directional Trades

Buying Puts as Bearish Directional Trade

Selecting Optimal Strike and Expiration

Bear Put Spreads as Mildly Bearish Directional Trade

Bear Diagonals as Bearish Longer Term Directional Trade

Management Strategies

1

VII. Option Strategies in Sideways Markets and Explosive Moves

Short Straddles and Strangles

Long Straddles and Strangles

Short Iron Condors for Range Bound Markets

Iron Butterflies

Numerous Examples, Plus Management Strategies

IX. Trade/Money Management and Adjustment Strategies

Money Management

Adding or Adjusting Positions as Bias Changes

Legging Into Iron Condors

Defensive and Offensive Rolling Techniques

Rolling Option Strikes Up/Down as Bias Changes

Rolling Option Expiration Up/Down as Bias Changes

Repair Strategies

II. Basics of Time Decay, Volatility, and Timing for Option Traders

Options Pricing and the “Greeks”

How Theta (Time Decay) Provides Edge to Option Sellers

VIX (“Fear Index”), High IVR, and Timing for Option Sellers

Normal Distribution and Probability of Profit

0

IV. Option Strategies for Bullish Directional Trades

Buying Calls as Bullish Directional Trade

Selecting Optimal Strike and Expiration

Buying Bull Call Spreads as Mildly Bullish Directional Trade

Buying Bull Diagonals as Bullish Longer Term Directional Trade

}

VI. Selling Options for Income Generation and Paycheck

Selling Naked Puts

Selecting Strike Price/Expiry

Selling Bull Put Spreads

Selling Naked Calls

Selling Bear Call Spreads

Numerous Examples, Plus Management Strategies

i

VIII. Trading Options on Gaps and News Stocks

Trading News

Trading Gaps

Pro Gaps

Novice Gaps

High IVR Patterns

X. Psychology, Trading Plan, Miscellaneous, and Bringing it All Together!

Discipline/Psychology

Trading Plan

Miscellaneous Topics

Review of Strategies in 4 Stages

Test Your Knowledge

Concluding Thoughts and Next Steps!

Delivery Policy

When will I receive my course?

You will receive a link to download/view your course immediately or within 1 to 24 hrs. It may takes few minutes, also few hours but never more than 24 hrs. Due to different time zone reasons.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you’ll receive an email with a google drive folder access link to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

Where can I find my course?

Once your order is complete, a link to download/view the course will be sent to your email.