Are you tired of traditional trading strategies that yield slow and inconsistent results? Look no further, because I have discovered a game-changing approach that can revolutionize your trading game. Welcome to the world of AM Profit – the art of scalping.

In this text, I will investigate into the intricacies of AM Profit – a highly effective trading technique that focuses on making quick, small profits by capitalizing on short-term price fluctuations. As an experienced trader, I can confidently say that this method has the potential to unlock immense profitability and provide you with a competitive edge in the market.

Join me as I explore the key principles, strategies, and tools that make AM Profit a force to be reckoned with. Whether you’re a seasoned trader looking to enhance your skills or a beginner seeking a reliable and efficient trading approach, AM Profit is the answer you’ve been searching for. So, buckle up and get ready to master the art of scalping with AM Profit.

What is AM Profit – Art Of Scalping?

AM Profit – Art Of Scalping is a trading technique that aims to capitalize on short-term price fluctuations to make quick, small profits. It is a strategy that has gained popularity among experienced traders looking to enhance their skills and beginners seeking a reliable and efficient trading approach.

With AM Profit – Art Of Scalping, the focus is on taking advantage of the small price movements that occur throughout the day. By entering and exiting trades quickly, traders can aim to make consistent profits without relying on big market moves.

This trading technique requires a high level of attention and quick decision-making. Traders using AM Profit – Art Of Scalping often use technical analysis tools to identify potential trade setups and determine entry and exit points. They may also use advanced order types and automation tools to streamline their trading process.

The goal of AM Profit – Art Of Scalping is to accumulate multiple small profits over time, rather than aiming for a few big wins. This approach allows traders to manage their risk more effectively and potentially achieve a higher overall success rate.

In the next section, I will investigate into the key principles and strategies of AM Profit – Art Of Scalping, providing valuable insights for traders who want to carry out this technique into their trading routine.

The Advantages of AM Profit

As a seasoned trader, I have found that AM Profit – Art Of Scalping can offer numerous advantages for those seeking short-term trading opportunities. Let me share some of the key benefits that this strategy provides:

Quick profit potential: AM Profit allows traders to capitalize on small price movements throughout the day, aiming to make quick profits. By entering and exiting trades swiftly, traders have the opportunity to accumulate multiple small profits, which can add up over time.

Lower risk exposure: Due to the short duration of each trade, AM Profit helps manage risk effectively. The strategy focuses on taking advantage of quick market fluctuations, minimizing the potential for significant losses. This risk management approach can be beneficial for both experienced traders and beginners.

Flexibility in market conditions: One of the advantages of AM Profit is that it can be applied to various market conditions. Whether the market is experiencing high volatility or a more stable period, this strategy can adapt and take advantage of short-term price movements.

Enhanced decision-making skills: AM Profit requires traders to make quick decisions based on technical analysis and market indicators. By actively engaging in this trading style, traders can improve their decision-making skills and gain valuable experience in analyzing market trends.

Potential for higher success rate: The focus on small price movements and effective risk management in AM Profit can potentially lead to a higher success rate. While individual trades may result in small profits, the cumulative effect can lead to a higher overall success rate for traders implementing this strategy.

To conclude, AM Profit – Art Of Scalping offers several advantages for those interested in short-term trading. It provides quick profit potential, mitigates risk exposure, adapts to different market conditions, enhances decision-making skills, and has the potential for a higher success rate. By applying this strategy effectively, traders can capitalize on small price fluctuations and achieve their trading goals.

Key Principles of AM Profit

In this section, I will outline the key principles of AM Profit – Art Of Scalping to provide you with a clear understanding of how this trading technique works. These principles serve as the foundation of the strategy and can help you achieve success in short-term trading.

Quick Entries and Exits: AM Profit focuses on capitalizing on short-term price fluctuations by entering and exiting trades swiftly. This allows traders to take advantage of immediate market opportunities and make quick profits.

Multiple Small Profits: Instead of aiming for one big profit, AM Profit emphasizes accumulating multiple small profits over time. By consistently making small gains, traders can steadily grow their trading account and minimize the impact of potential losses.

Effective Risk Management: Risk management is a crucial aspect of AM Profit. Traders use stop-loss orders to limit potential losses and protect their capital. By setting predefined exit points, traders can control their risk and avoid significant drawdowns.

Adaptability to Market Conditions: AM Profit is a versatile strategy that can be applied to various market conditions. Whether the market is trending, ranging, or experiencing high volatility, traders can adjust their trading approach accordingly to maximize profits.

Enhanced Decision-Making Skills: Scalping requires traders to make quick decisions based on rapid market movements. Through practicing AM Profit, traders can develop their decision-making skills and become more confident in their trading judgments.

Higher Success Rate Potential: The focus on multiple small profits and efficient risk management in AM Profit increases the potential for a higher success rate. By taking advantage of short-term price fluctuations, traders can increase the probability of profitable trades.

These key principles form the core components of AM Profit – Art Of Scalping. By understanding and applying these principles in your trading, you can enhance your chances of success in the world of short-term trading.

Strategies for Successful Scalping

Scalping requires precision, quick decision-making, and efficient execution. To maximize your success in this trading technique, here are some key strategies to consider:

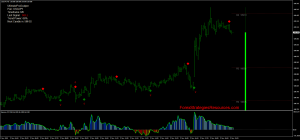

Choose the Right Timeframe: Scalpers typically focus on short-term timeframes, such as one-minute or five-minute charts. These shorter timeframes allow for more frequent opportunities to enter and exit trades.

Identify Support and Resistance Levels: Support and resistance levels can be valuable indicators for scalp traders. Identifying these levels can help you determine potential entry and exit points, increasing the probability of profitable trades.

Use Technical Indicators: Technical indicators can provide additional insights and confirmations for scalp trading. Popular indicators such as moving averages, oscillators, and volume can help identify trends, reversals, and market strength.

Manage Risk Effectively: Risk management is crucial in scalp trading. Set strict stop-loss orders to limit potential losses and always follow your risk management strategy. Remember, even small losses can accumulate if not managed properly.

Control Emotions: Emotions can easily cloud judgment and lead to impulsive decisions. Stay disciplined and stick to your trading plan. Avoid chasing trades or holding onto losing positions for too long.

Focus on Liquidity: Scalping is most effective in highly liquid markets. Liquidity ensures that you can enter and exit trades swiftly, minimizing slippage and maximizing your potential profits.

Practice and Analyze: Like any trading strategy, practice is essential. Start with a demo account to refine your skills and analyze your trades. Keep a trading journal to track your performance and identify areas for improvement.

Remember, successful scalping requires practice, discipline, and a well-defined strategy. Develop your skills over time and adapt your approach as market conditions evolve. With dedication and the right strategies, you can enhance your chances of success in short-term trading.

Essential Tools for AM Profit

When it comes to successful scalping using the AM Profit – Art Of Scalping technique, having the right tools at your disposal is crucial. These tools can help you make informed trading decisions and maximize your profits. Here are some essential tools that every scalper should consider using:

Real-Time Market Data: Access to real-time market data is essential for scalping. It allows you to track price movements and identify potential trading opportunities. With up-to-date information, you can make quick and accurate decisions.

Trading Platform: A reliable and user-friendly trading platform is a must-have for scalpers. Look for a platform that offers fast execution, advanced charting capabilities, and customizable settings. This will enable you to execute trades swiftly and efficiently.

Technical Indicators: Technical indicators can provide valuable insights into market trends and price movements. Popular indicators for scalping include Moving Averages, Bollinger Bands, and Relative Strength Index (RSI). These tools can help you spot entry and exit points for profitable trades.

Order Types: Different order types can be beneficial for scalpers. Limit orders allow you to set a specific price at which you want to enter or exit a trade. Stop orders can help you minimize losses by automatically closing a position if the market moves against you.

Risk Management Tools: Effective risk management is crucial for scalpers. Consider using tools like stop-loss orders and take-profit orders to manage your risk. These tools can help you set predetermined levels at which you want to exit a trade, whether to limit losses or secure profits.

News and Economic Calendar: Staying informed about market news and economic events can help you anticipate price movements and adjust your trading strategy accordingly. Use reliable sources of news and an economic calendar to plan your trades and stay ahead of market developments.

Remember, the success of scalping depends on using the right tools and implementing a well-defined strategy. Experiment with different tools and find the ones that work best for you. Regularly assess and analyze your trades to identify areas for improvement and adapt your approach as market conditions evolve.

Conclusion

To conclude, AM Profit – Art Of Scalping offers traders a powerful technique for capitalizing on short-term price fluctuations in the market. By implementing the strategies discussed in this text, traders can increase their chances of success in scalping.

Choosing the right timeframe, identifying support and resistance levels, and using technical indicators are essential steps in executing successful scalping trades. Also, managing risk effectively, controlling emotions, and focusing on liquidity are crucial for maintaining a disciplined approach to scalping.

Having the right tools is also key to successful scalping. Traders should ensure they have access to real-time market data, a reliable trading platform, and various technical indicators. Different order types, risk management tools, and staying informed about market news and economic events are also essential for making informed trading decisions.

To excel in scalping, traders should experiment with different tools, regularly assess and analyze their trades, and adapt their approach as market conditions evolve. By following these guidelines, traders can improve their scalping skills and increase their profitability in the market.

Frequently Asked Questions

Q: What is AM Profit – Art Of Scalping?

A: AM Profit – Art Of Scalping is a trading technique that aims to capitalize on short-term price fluctuations.

Q: What are the strategies for successful scalping?

A: Strategies for successful scalping include choosing the right timeframe, identifying support and resistance levels, using technical indicators, managing risk effectively, controlling emotions, focusing on liquidity, and practicing and analyzing trades.

Q: What tools are important for successful scalping?

A: Important tools for successful scalping include real-time market data, a reliable trading platform, technical indicators, different order types, risk management tools, and staying informed about market news and economic events.

Q: How can traders improve their scalping approach?

A: Traders can improve their scalping approach by experimenting with different tools, regularly assessing and analyzing trades, and adapting their approach as market conditions evolve.