Are you looking to take your options trading to the next level? Look no further than Sheridan Mentoring’s Double Calendars & Double Diagonals strategy. As an experienced options trader, I can confidently say that this strategy has the potential to enhance your trading results and maximize your profits. In this text, I’ll investigate into the intricacies of these advanced options strategies and explain how you can effectively carry out them in your own trading portfolio. So, let’s immerse and discover the power of Sheridan Mentoring’s Double Calendars & Double Diagonals.

When it comes to options trading, it’s crucial to have a diverse range of strategies in your arsenal. That’s where Sheridan Mentoring’s Double Calendars & Double Diagonals come in. These strategies offer a unique approach to trading options, allowing you to take advantage of both time decay and volatility. In this text, I’ll walk you through the step-by-step process of setting up and managing these trades, ensuring that you have a clear understanding of how to execute them effectively. Whether you’re a beginner or an experienced trader, Sheridan Mentoring’s Double Calendars & Double Diagonals can provide you with a valuable edge in the options market. So, let’s get started and unlock the potential of these powerful strategies.

What are Double Calendars & Double Diagonals? What are Double Calendars & Double Diagonals?

In the world of options trading, Double Calendars and Double Diagonals are popular strategies that offer traders the opportunity to optimize their trading results and maximize profits. These strategies allow you to take advantage of both time decay and volatility, making them versatile and powerful tools to have in your trading arsenal.

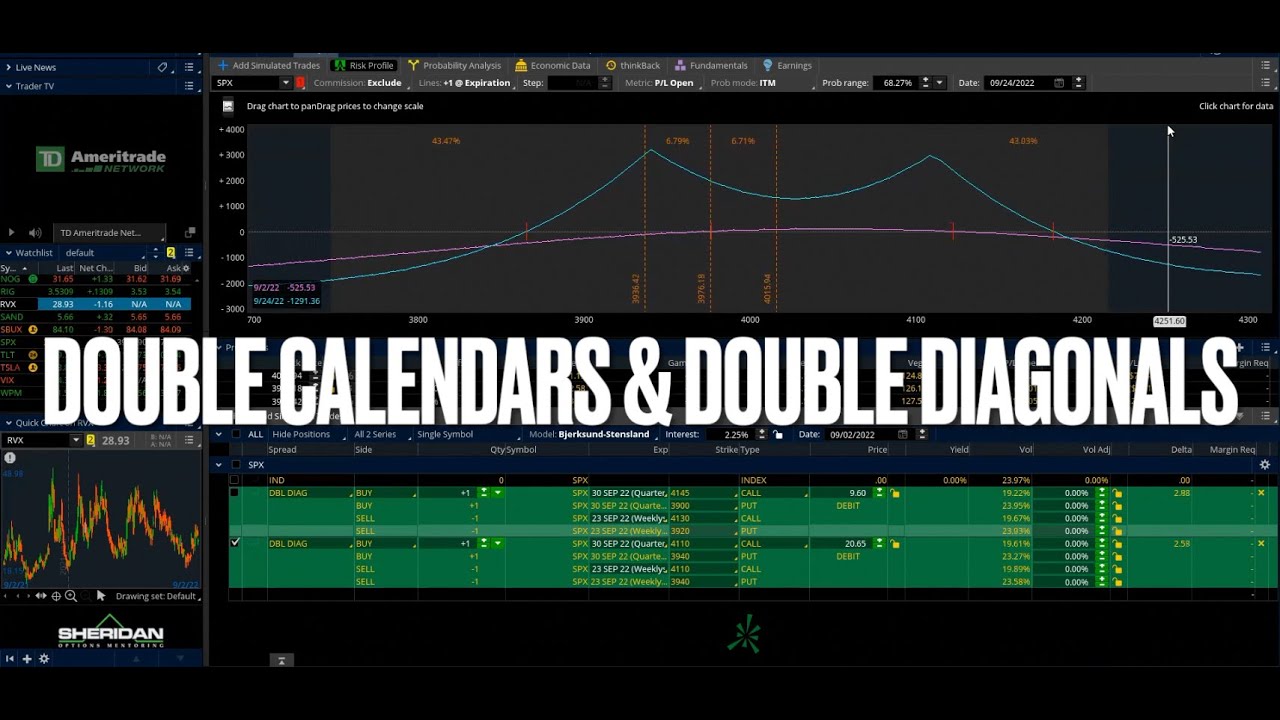

A Double Calendar involves simultaneously buying and selling two different expiration dates for option contracts. This strategy benefits from time decay, as the options that you sell will lose value over time, while the options you buy will retain their value. By carefully selecting the expiration dates, you can create a window of opportunity where the value of the options you sell will decay faster than the options you buy, resulting in potential profits.

On the other hand, a Double Diagonal strategy takes it a step further by not only playing with different expiration dates but also different strike prices. This adds another layer of complexity and flexibility to the strategy, allowing you to potentially profit from changes in volatility as well. By choosing strike prices that are further apart, you can increase the potential profit if the underlying asset makes a significant move.

Setting up and managing these trades requires careful planning and analysis. It’s essential to consider factors like the current market conditions, implied volatility, and the risk/reward ratio before executing these strategies. But, with proper guidance and practice, both beginners and experienced traders can learn how to effectively carry out Double Calendars and Double Diagonals.

Summarizing, Double Calendars & Double Diagonals offer traders a unique opportunity to capitalize on both time decay and volatility in options trading. By understanding the mechanics of each strategy and applying the right techniques, you can potentially unlock greater profits. Next, let’s explore the step-by-step process for setting up and managing these trades to help you get started on your options trading journey.

Advantages of Double Calendars & Double Diagonals

When it comes to options trading, Double Calendars & Double Diagonals can offer some significant advantages. Here are a few key benefits of these strategies:

Profit Potential: Double Calendars & Double Diagonals allow traders to potentially profit from both time decay and volatility. By combining different expiration dates and strike prices, these strategies can create opportunities for gains in a variety of market conditions.

Limited Risk: With Double Calendars & Double Diagonals, the risk is limited to the cost of the options contracts. This means that traders can define their maximum potential loss upfront, providing a level of protection and peace of mind.

Flexibility and Adaptability: These strategies offer flexibility in managing positions. Traders can adjust the strikes and expirations to adapt to changing market conditions, allowing them to stay in control and potentially optimize their trades.

Diversification: Double Calendars & Double Diagonals provide traders with a way to diversify their options trading portfolio. By utilizing different expiration dates and strike prices, they can spread their risk across multiple positions, reducing the impact of any single trade.

Suitable for Different Trading Levels: Whether you’re a beginner or an experienced trader, Double Calendars & Double Diagonals can be utilized at various skill levels. They offer a structured approach to options trading while still allowing room for customization and personalization.

By understanding the advantages of Double Calendars & Double Diagonals, traders can make informed decisions and potentially unlock greater profits in their options trading journey.

How to Set Up Double Calendars & Double Diagonals

When it comes to options trading, setting up Double Calendars and Double Diagonals can be a strategic move to potentially increase profits. Let me walk you through the steps of setting up these powerful strategies.

When it comes to options trading, setting up Double Calendars and Double Diagonals can be a strategic move to potentially increase profits. Let me walk you through the steps of setting up these powerful strategies.

Choose the underlying asset: Start by selecting an underlying asset that you believe will have stable or limited movement in the near term. This is important because both Double Calendars and Double Diagonals thrive on low volatility.

Identify strike prices: Determine the strike prices for your options based on your market analysis and desired risk level. For Double Calendars, you’ll select two strike prices for the outer legs, while for Double Diagonals, you’ll choose four strike prices.

Select expiration dates: Choose two different expiration dates for Double Calendars, whereas for Double Diagonals, you’ll have four expiration dates to consider. Be mindful of the time decay factor and choose expiration dates accordingly.

Enter the trades: Place the trades by buying options at the selected strike prices and expiration dates. For Double Calendars, you’ll sell options at the inner strike prices, while for Double Diagonals, you’ll sell options at both the inner and outer strike prices.

Manage the positions: Monitor your positions closely and be prepared to make adjustments. If the underlying asset stays within your expected range, you can let the options expire. But, if the asset price moves outside your range, you can adjust or close the positions to limit potential losses.

Setting up Double Calendars and Double Diagonals requires careful analysis and decision making, but with practice, you can effectively use these strategies to your advantage. Happy trading!

Note: It’s important to consult with a professional financial advisor or options trading mentor before implementing these strategies to ensure they align with your investment goals and risk tolerance.

Managing Double Calendars & Double Diagonals Trades

When it comes to managing Double Calendars and Double Diagonals trades, there are a few important factors to consider. These strategies offer the potential for profit from both time decay and volatility, while also providing limited risk and flexibility in managing positions. Here are some key points to keep in mind:

Monitoring the Market: As with any options trading strategy, it’s important to stay on top of market conditions and trends. Keep an eye on any news or events that could potentially impact the underlying asset. This will help you make informed decisions when it comes to managing your trades.

Adjusting Strike Prices: One way to manage Double Calendars and Double Diagonals trades is by adjusting the strike prices of the options contracts. If the market moves significantly in one direction, you may consider moving the strike prices closer together to reduce risk. On the other hand, if the market remains stable, you may choose to widen the strike prices to potentially increase profitability.

Rolling Options: Another strategy to consider is rolling options contracts. This involves closing out existing options positions and opening new ones with different expiration dates or strike prices. Rolling options can be used to lock in profits, extend the duration of the trade, or adjust the position to reflect changing market conditions.

Setting Stop Loss: It’s a good idea to set a stop loss level for your trades. This is a predetermined price at which you will exit the trade if the market moves against you. Setting a stop loss helps protect your capital and manage risk in case the market doesn’t perform as anticipated.

Remember, managing Double Calendars and Double Diagonals trades requires careful analysis and decision making. It’s always a good idea to consult with a professional financial advisor or options trading mentor before implementing these strategies. They can provide guidance and help you tailor your approach to your individual trading goals and risk tolerance.

Tips for Successful Double Calendars & Double Diagonals Trading

One of the key factors to successful Double Calendars & Double Diagonals trading is careful analysis and decision making. Here are some tips to help you maximize your potential profits while minimizing your risks:

Choose the Right Underlying Asset: Select an underlying asset that has good liquidity and is suitable for options trading. Look for assets that have a history of moderate price fluctuations and a wide range of strike prices available.

Identify Strike Prices Wisely: When setting up your Double Calendars or Double Diagonals, choose strike prices that you believe are likely to hold during the duration of the trade. Consider both fundamental and technical factors that could impact the price movement of the underlying asset.

Select Suitable Expiration Dates: It’s important to choose expiration dates that align with your trading goals. If you want to take advantage of time decay, select shorter-term options. If you’re looking to capitalize on an increase in volatility, opt for longer-term options.

Carry out Trade Entries Carefully: When entering your Double Calendars or Double Diagonals trades, it’s crucial to execute them precisely according to your strategy. Make sure to use limit orders to control the prices at which your trades are filled.

Monitor the Market Continuously: Keep a close eye on the market conditions and any news or events that could impact the underlying asset. Stay informed about any changes to market sentiment, economic indicators, or company-specific developments that may influence your trades.

Adjust Strike Prices when Necessary: If the price of the underlying asset moves significantly, you may need to adjust your strike prices to maintain a balanced position. This adjustment can help ensure that your profit potential remains intact.

Consider Rolling Options: If your trades are not going as planned, you may want to consider rolling your options to extend the duration or adjust the strike prices. Rolling options can help you manage risk and potentially improve the profitability of your trades.

Set Stop Loss Levels: Establishing stop loss levels is crucial to protect yourself from significant losses in case the trade doesn’t go as anticipated. Determine a point at which you’ll exit the trade to limit your potential losses.

Conclusion

In this text, I have discussed the advantages of using Double Calendars & Double Diagonals as strategies in options trading. These strategies offer the potential for profit from both time decay and volatility, while also providing limited risk and flexibility in managing positions.

I have provided a step-by-step guide on how to set up Double Calendars and Double Diagonals, including choosing the underlying asset, identifying strike prices, selecting expiration dates, entering the trades, and managing the positions. It is important to emphasize the importance of careful analysis and decision making, and I recommend consulting with a professional financial advisor or options trading mentor before implementing these strategies.

I have also covered important factors to consider when managing Double Calendars and Double Diagonals trades, such as monitoring the market, adjusting strike prices, rolling options, and setting stop loss levels. It is crucial to continuously analyze the market and make informed decisions. Consulting with a professional financial advisor or options trading mentor can provide tailored guidance based on individual trading goals and risk tolerance.

To succeed in Double Calendars & Double Diagonals trading, it is essential to choose the right underlying asset, identify strike prices wisely, select suitable expiration dates, carry out trade entries carefully, monitor the market continuously, adjust strike prices when necessary, consider rolling options, and set stop loss levels to protect against significant losses.

By following these strategies and tips, traders can take advantage of the potential profits and flexibility offered by Double Calendars & Double Diagonals in options trading

Frequently Asked Questions

1. What are Double Calendars & Double Diagonals?

Double Calendars and Double Diagonals are options trading strategies that allow traders to profit from both time decay and volatility. These strategies involve the simultaneous buying and selling of options with different strike prices and expiration dates.

2. What are the advantages of using Double Calendars & Double Diagonals?

Double Calendars and Double Diagonals offer limited risk, potential for profit from time decay and volatility, and flexibility in managing positions. These strategies can be used in various market conditions and can provide a well-balanced approach to options trading.

3. How do I set up Double Calendars & Double Diagonals?

To set up Double Calendars and Double Diagonals, you need to choose an underlying asset, identify strike prices, select expiration dates, enter the trades, and manage the positions. It is crucial to carefully analyze the market and seek guidance from a professional financial advisor or options trading mentor.

4. What should I consider when managing Double Calendars & Double Diagonals trades?

When managing Double Calendars and Double Diagonals trades, it is important to monitor the market, adjust strike prices if necessary, consider rolling options, and set stop loss levels to protect against significant losses. Make informed decisions based on careful analysis and consult with a professional financial advisor or options trading mentor.

5. What tips can you provide for successful Double Calendars & Double Diagonals trading?

To succeed in Double Calendars and Double Diagonals trading, choose the right underlying asset, identify strike prices wisely, select suitable expiration dates, execute trade entries carefully, monitor the market continuously, adjust strike prices when necessary, consider rolling options, and set stop loss levels to protect against significant losses. Seek guidance tailored to your trading goals and risk tolerance from a professional financial advisor or options trading mentor.