Are you tired of guessing which way the market will move? Look no further than Nick Santiago – the master of gap trading. With years of experience and a proven track record, Nick Santiago has become the go-to expert for traders looking to profit from market gaps.

In this text, I’ll introduce you to Nick Santiago and his elite gap trading strategies. From identifying key support and resistance levels to analyzing market trends, Nick has honed his skills to consistently capitalize on market gaps. Whether you’re a seasoned trader or just starting out, Nick’s insights and techniques will take your trading to the next level.

Join me as we investigate into the world of Nick Santiago – the man who has cracked the code of gap trading. Get ready to uncover the secrets behind his success and learn how you can apply his strategies to maximize your profits. Let’s immerse and discover the power of elite gap trading with Nick Santiago.

Who is Nick Santiago?

I’ve been in the trading industry for many years, and I can confidently say that Nick Santiago is one of the most respected experts in the field of gap trading. With his extensive knowledge and proven track record, Nick has established himself as a trusted authority in the industry.

Nick’s expertise lies in identifying support and resistance levels, as well as analyzing market trends to profit from market gaps. His unique strategies and techniques have helped many traders enhance their skills and achieve consistent success in the market.

What sets Nick apart from others is his ability to accurately predict market movements based on his deep understanding of technical analysis. He has an impressive track record of identifying profitable trading opportunities by analyzing charts and patterns.

As a trader, I’ve personally benefited from Nick’s insights and techniques. His ability to cut through the noise and focus on the most relevant market information has greatly improved my decision-making process. I’ve learned valuable lessons from him about risk management, trade execution, and market psychology.

Whether you’re a novice trader looking to learn the basics or an experienced trader looking to take your skills to the next level, Nick Santiago’s expertise is invaluable. I highly recommend exploring his teachings and incorporating his strategies into your trading approach.

Overall, Nick Santiago’s reputation as an elite gap trader is well-deserved, and his insights can be a game-changer for any trader. So if you’re serious about improving your trading skills and achieving consistent profitability, make sure to learn from the best – Nick Santiago.

The Importance of Gap Trading

Gap trading is an essential strategy in the world of trading that can offer significant opportunities for profit. Understanding the importance of gap trading can help traders capitalize on market movements and make informed decisions.

1. Identifying Potential Market Breakouts

Gap trading allows traders to identify potential market breakouts. A gap occurs when the price of an asset opens significantly higher or lower than its previous closing price. These gaps can indicate a strong market momentum and the potential for a breakout.

2. Exploiting Price Discrepancies

Gap trading offers an opportunity to exploit price discrepancies between the closing and opening prices. Traders can take advantage of these gaps by buying or selling assets at a more favorable price, potentially maximizing gains and minimizing losses.

3. Reacting to Market News

Gap trading enables traders to react quickly to market news and events. When significant news is released outside of trading hours, it can cause a gap in the price of an asset when the market reopens. By monitoring news and understanding its potential impact, traders can take advantage of these gaps and position themselves for profitable trades.

4. Analyzing Market Trends

Gap trading is a powerful tool for analyzing market trends. By observing the size and direction of gaps over time, traders can gain insights into market sentiment and identify potential patterns. This analysis can help traders make informed decisions and improve their overall trading strategies.

5. Enhancing Risk Management

Gap trading can also contribute to improved risk management. By understanding the potential risks and rewards associated with trading gaps, traders can develop strategies that align with their risk tolerance. Incorporating gap trading into a comprehensive risk management plan can help traders mitigate losses and protect their capital.

To conclude, gap trading plays a crucial role in the world of trading. By identifying potential breakouts, exploiting price discrepancies, reacting to market news, analyzing market trends, and enhancing risk management, traders can leverage gap trading to their advantage. It is an essential strategy that every trader should understand and explore to maximize their trading potential.

Identifying Key Support and Resistance Levels

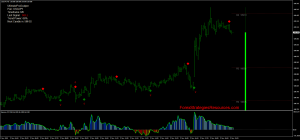

When it comes to gap trading, one of the key skills that sets Nick Santiago apart as an elite trader is his ability to identify key support and resistance levels. These levels play a crucial role in determining the potential direction of price movements.

Support levels are price levels where buying interest is strong enough to prevent the price from falling further. On the other hand, resistance levels are price levels where selling pressure is strong enough to prevent the price from rising further. By accurately identifying these levels, Nick can anticipate potential reversals or breakouts in the market.

To identify these key levels, Nick utilizes a combination of technical analysis tools and indicators. He analyzes price charts, trend lines, moving averages, and previous market patterns to identify areas where support or resistance is likely to occur. By focusing on these levels, he is able to make more informed trading decisions and improve his overall success rate.

It’s important to note that support and resistance levels are not static. They can shift and change as market conditions evolve. That’s why Nick constantly monitors the market and adjusts his analysis accordingly. This adaptive approach allows him to stay ahead of potential price movements and capitalize on profitable trading opportunities.

Overall, identifying key support and resistance levels is an essential skill for gap traders. By understanding these levels and their significance in the market, traders can make more accurate predictions and increase their chances of success. In the next section, we’ll explore another aspect of gap trading: exploiting price discrepancies.

Analyzing Market Trends

As an expert in gap trading, one of the key aspects of my strategy is analyzing market trends. By studying the direction and momentum of the market, I am able to make informed decisions and maximize my profits.

When analyzing market trends, I look for patterns and indicators that can help me predict future price movements. This involves studying historical price data, using technical analysis tools, and keeping a close eye on market news and events.

Trend identification: I focus on identifying the overall direction of the market, whether it’s in an uptrend, downtrend, or ranging. This allows me to align my trades with the prevailing trend and increase my chances of success.

Momentum analysis: I pay attention to the strength of the market trend by analyzing indicators such as moving averages, MACD, and RSI. This helps me gauge the momentum behind the price movement and determine if it’s likely to continue or reverse.

Support and resistance levels: I also consider the key support and resistance levels in the market. These levels act as barriers where the price tends to reverse or break through. By accurately identifying these levels, I can anticipate potential reversals or breakouts and plan my trades accordingly.

Volume analysis: Volume is an important indicator of market participation and can provide valuable insights into the strength of a trend. High volume during an uptrend confirms bullish sentiment, while low volume during a downtrend suggests bearishness.

By analyzing market trends, I am able to stay ahead of potential price movements and capitalize on profitable trading opportunities. The ability to accurately predict market trends is a valuable skill that sets successful traders apart.

As a gap trader, I combine my knowledge of identifying support and resistance levels and analyzing market trends to create a comprehensive trading strategy that consistently delivers results.

Nick Santiago’s Elite Gap Trading Strategies

When it comes to gap trading, Nick Santiago’s strategies are in a league of their own. With his extensive market knowledge and proven track record, Nick has mastered the art of capitalizing on market gaps to generate consistent profits. Here’s an insight into some of his elite gap trading strategies:

1. Identifying Potential Breakouts

One of the key aspects of Nick Santiago’s gap trading strategy is identifying potential market breakouts. By carefully analyzing charts and technical indicators, he can spot price patterns that indicate a potential breakout. These breakouts offer excellent trading opportunities with the potential for significant profits.

2. Exploiting Price Discrepancies

Another aspect of Nick’s elite gap trading strategy involves exploiting price discrepancies. He actively looks for gaps between the previous day’s close and the next day’s open, as these gaps often present buying or selling opportunities. By taking advantage of these price discrepancies, Nick can enter trades with a favorable risk-to-reward ratio.

3. Reacting to Market News

Staying updated with market news is essential for successful gap trading, and Nick Santiago excels in this area. He closely monitors economic indicators, corporate earnings reports, and other market-moving events to gauge their impact on price gaps. This allows him to react swiftly and make informed trading decisions based on the latest market developments.

4. Analyzing Market Trends

Analyzing market trends is a fundamental aspect of Nick’s gap trading strategy. He studies the direction and momentum of the market, taking into consideration key support and resistance levels, volume, and market indicators. By accurately predicting market trends, Nick can position himself ahead of potential price movements and capitalize on profitable trading opportunities.

5. Enhancing Risk Management

Effective risk management is crucial for successful gap trading, and Nick Santiago prioritizes this aspect in his strategies. He employs various risk management techniques, including setting stop-loss orders and utilizing proper position sizing to limit potential losses and protect his capital. By managing risk effectively, Nick ensures that each trade has a well-defined risk-reward ratio.

Nick Santiago’s elite gap trading strategies are a culmination of his years of experience and expertise in the market. By implementing these strategies with precision and discipline, he consistently achieves impressive results. Whether you are a seasoned trader or just starting, learning from Nick’s strategies can provide valuable insights and enhance your own trading approach.

Applying Nick Santiago’s Strategies to Maximize Profits

As I mentioned earlier, Nick Santiago’s expertise in gap trading is unparalleled. His elite strategies have consistently helped traders maximize their profits. In this section, I will investigate deeper into some of Nick’s strategies and how you can apply them to achieve impressive results.

Identifying Potential Breakouts: One of the key aspects of Nick’s approach is identifying potential market breakouts. By studying support and resistance levels, as well as analyzing market trends, Nick has a knack for pinpointing stocks that are on the verge of making significant moves. By learning this skill, you can capitalize on these opportunities and potentially experience substantial gains.

Exploiting Price Discrepancies: Another strategy that sets Nick apart is his ability to exploit price discrepancies. By closely monitoring different markets and sectors, Nick can identify price disparities that create profitable trading opportunities. Understanding this strategy can give you an edge in capitalizing on price inefficiencies and increasing your profitability.

Reacting to Market News: Keeping a close eye on market news and reacting swiftly is crucial in the world of trading. Nick Santiago’s strategies emphasize the importance of staying informed about significant market events, ranging from economic indicators to company earnings reports. By having a solid grasp of market news and understanding its impact on price movements, you can make well-informed trading decisions and increase your chances of success.

Analyzing Market Trends: Nick’s trading methods revolve around analyzing market trends. He uses various technical analysis tools to identify trends, patterns, and support and resistance levels. By understanding how to interpret these indicators, you can make more informed trading decisions and align yourself with the prevailing market direction.

Enhancing Risk Management: Risk management is a crucial aspect of successful trading, and Nick Santiago recognizes its importance. His strategies incorporate risk management techniques to protect capital and minimize potential losses. By learning and implementing these techniques, you can effectively manage your risk exposure and safeguard your trading capital.

By incorporating these strategies into your trading approach, you can maximize your profits and achieve better results. Learning from Nick Santiago’s expertise can provide valuable insights and eventually enhance your overall trading performance.

Remember, success in trading requires discipline, knowledge, and continuous learning. By integrating these strategies into your trading routine and adapting them to your own style, you can set yourself on a path to becoming a successful gap trader. So, start applying Nick’s strategies today and take your trading to the next level.

Conclusion

To conclude, Nick Santiago’s elite gap trading strategies offer valuable insights and techniques that can enhance your overall trading performance. His extensive knowledge and proven track record in identifying support and resistance levels, analyzing market trends, and accurately predicting market movements set him apart from others in the field.

By implementing Nick’s strategies with precision and discipline, you can maximize your profits and achieve better results. Whether it’s identifying potential breakouts, exploiting price discrepancies, reacting to market news, analyzing market trends, or enhancing risk management, Nick’s expertise provides a comprehensive approach to gap trading.

Personally, I have benefited from Nick’s insights and techniques, particularly in risk management, trade execution, and market psychology. His strategies have helped me navigate the market with confidence and achieve consistent results.

Incorporating Nick Santiago’s elite gap trading strategies into your own trading approach can significantly improve your chances of success. By learning from his expertise, you can gain valuable insights and eventually enhance your overall trading performance. So, why not take advantage of Nick’s knowledge and start implementing his strategies today?

Frequently Asked Questions

Q: What is Nick Santiago’s area of expertise?

A: Nick Santiago is an expert in gap trading, specializing in identifying support and resistance levels, analyzing market trends, and capitalizing on market gaps.

Q: What sets Nick Santiago apart from others in the industry?

A: Nick’s ability to predict market movements accurately, based on his deep understanding of technical analysis, sets him apart from others in the industry.

Q: How can I benefit from Nick Santiago’s insights and techniques?

A: By learning from Nick’s insights and techniques, particularly in risk management, trade execution, and market psychology, you can enhance your overall trading performance.

Q: What are the key aspects of gap trading?

A: Gap trading involves identifying potential market breakouts, exploiting price discrepancies, reacting to market news, analyzing market trends, and enhancing risk management.

Q: What strategies does Nick Santiago employ for gap trading?

A: Nick Santiago employs strategies such as identifying potential breakouts, exploiting price discrepancies, reacting to market news, analyzing market trends, and enhancing risk management for gap trading.

Q: How can I apply Nick Santiago’s strategies to maximize profits?

A: By incorporating Nick Santiago’s strategies, including identifying potential breakouts, exploiting price discrepancies, reacting to market news, analyzing market trends, and enhancing risk management, you can maximize your profits and achieve better results.