Python for Traders Masterclass 2024

Python for Traders Masterclass 2024 course is now available at an affordable price. You can check out directly using multiple payment gateway options. If you have any questions or need an alternative payment method, feel free to contact us.

Description

Python for Traders Masterclass 2024 Download

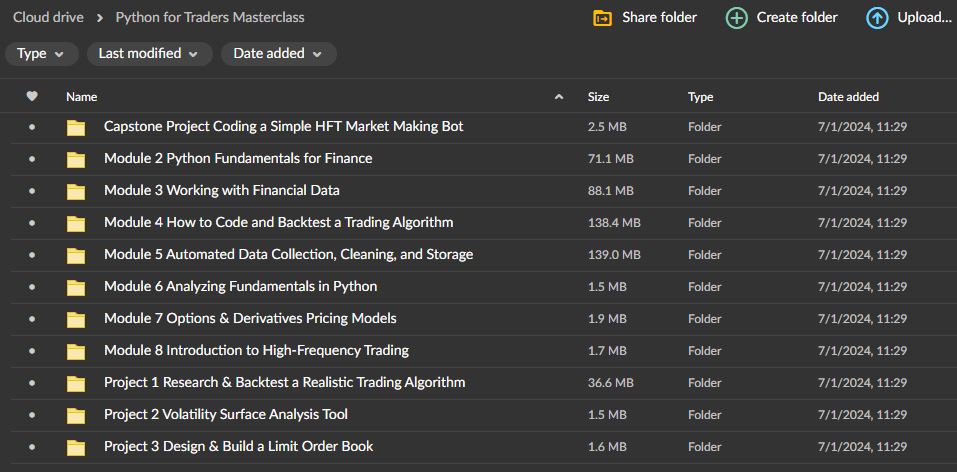

Python for Traders Masterclass 2024 | Size: 484 MB

About Course:

The Python for Traders Masterclass

8 Modules

4 Projects

105 Lessons

248 Code Examples

34 Hours of Content

Module 1: Introduction

1.1. Welcome to the Python for Traders Masterclass(2:14)PREVIEW

1.2. Why learn to code as a trader?(7:15)PREVIEW

1.3. Why should traders learn Python?(4:23)PREVIEW

1.4. What will I gain from this course?PREVIEW

1.5. What topics will be covered?PREVIEW

1.6. Who is the intended audience for this course?PREVIEW

1.7. How much finance knowledge do I need?(1:40)PREVIEW

1.8. How much coding knowledge do I need?(1:37)PREVIEW

1.9. Placement Quiz: Am I a good fit for this course?PREVIEW

1.10. Module QuizSTART

Module 2: Python Fundamentals for Finance

2.1. Python Installation and SetupSTART

2.2. Running Python CodeSTART

2.3. Basic Python(26:34)START

2.4. Intermediate Python(5:07)START

2.5. Advanced PythonSTART

2.6. Data Science in PythonSTART

2.7. Key library: PandasSTART

2.8. Key library: NumPySTART

2.9. Key library: MatplotlibSTART

2.10. Key library: StatsmodelsSTART

2.11. Key library: Scikit-learnSTART

Module 3: Working with Financial Data

3.1. Introduction to Financial Data: Time Series and Cross-SectionsSTART

3.2. Data Acquisition and Cleaning(18:09)START

3.3. Time Series Analysis(13:38)START

3.4. Understanding Stationarity(11:55)START

3.5. Time Series ForecastingSTART

3.6. Exploratory Data AnalysisSTART

3.7. Section summarySTART

Module 4: How to Code and Backtest a Trading Algorithm

4.1. So what is a trading algorithm?START

4.2. Algorithm Design PrinciplesSTART

4.3. Data Management Module(15:12)START

4.4. Signal Generation Module(15:12)START

4.5. Risk Management Module(10:58)START

4.6. Trade Execution Module(10:27)START

4.7. Portfolio Management Module(11:05)START

4.8. Backtesting BasicsSTART

4.9. Backtesting SoftwareSTART

4.10. Advanced Backtesting TechniquesSTART

4.11. Optimization and Parameter TuningSTART

Project 1: Research & Backtest a Realistic Trading Algorithm

Project Overview(6:57)START

Step 1: Getting Started on QuantConnect(6:53)START

Step 2: Formulate a StrategySTART

Solution: Formulate a StrategySTART

Step 3: Develop the AlgorithmSTART

Solution: Develop the AlgorithmSTART

Step 4: Run a Backtesting AnalysisSTART

Solution 4: Run a Backtesting AnalysisSTART

Project SummarySTART

Module 5: Automated Data Collection, Cleaning, and Storage

5.1. Sourcing financial data(5:38)START

5.2. Working with CSVsSTART

5.3. Working with JSONSTART

5.4. Scraping data from APIs(51:35)START

5.5. Scraping data from websitesSTART

5.6. Persisting data: files and databasesSTART

5.7. Section summarySTART

Module 6: Analyzing Fundamentals in Python

6.1. Structured vs. Unstructured DataSTART

6.2. Types of Fundamental DataSTART

6.3. Gathering & Cleaning Fundamental DataSTART

6.4. Automated Screening & FilteringSTART

6.5. Statistical Analysis of Fundamental DataSTART

6.6. Natural Language Processing on News ArticlesSTART

6.7. Natural Language Processing on Annual ReportsSTART

6.8. Using LLMs for Natural Language ProcessingSTART

Module 7: Options & Derivatives Pricing Models

7.1. Introduction to Options & DerivativesSTART

7.2. Basics of Option PricingSTART

7.3. The Binomial Options Pricing ModelSTART

7.4. The Black-Scholes-Merton ModelSTART

7.5. Monte Carlo Simulation for Option PricingSTART

7.6. Introduction to Exotic OptionsSTART

7.7. Interest Rate Derivatives and Term StructureSTART

7.8. Implementing Finite Difference Methods for Option PricingSTART

7.9. Volatility and Implied VolatilitySTART

7.10. Advanced Topics and Modern Developments (Optional)START

Project 2: Volatility Surface Analysis Tool

Project OverviewSTART

Step 1: Fetching Options DataSTART

Solution: Fetching Options DataSTART

Step 2: Calculating Implied VolatilitiesSTART

Solution: Calculating Implied VolatilitiesSTART

Step 3: Plot a 3D Volatility SurfaceSTART

Solution: Plot a 3D Volatility SurfaceSTART

Project SummarySTART

Module 8: Introduction to High-Frequency Trading

8.1. What is High Frequency Trading (HFT)?START

8.2. Handling High-Frequency Tick DataSTART

8.3. Latency Measurement and SimulationSTART

8.4. Understanding the HFT Market Making StrategySTART

8.5. Understanding Statistical Arbitrage with High-Frequency DataSTART

8.6. Signal Processing for HFTSTART

8.7. Real-time News ProcessingSTART

8.8. Section summarySTART

Project 3: Design & Build a Limit Order Book

Project OverviewSTART

Step 1: Design the Data StructureSTART

Solution: Design the Data StructureSTART

Step 2: Add FunctionalitySTART

Solution: Add FunctionalitySTART

Step 3: Simulate Live OrdersSTART

Solution: Simulate Live OrdersSTART

Project SummarySTART

Capstone Project: Coding a Simple HFT Market Making Bot

Project OverviewSTART

Step 1: Define a System and Class ArchitectureSTART

Solution: Define a System and Class ArchitectureSTART

Step 2: Define the Event LoopSTART

Solution: Define the Event LoopSTART

Step 3: Implement the Data FeedsSTART

Solution: Implement the Data FeedsSTART

Step 4: Implement the Order ManagerSTART

Solution: Implement the Order ManagerSTART

Step 5: Add Alpha to the Pricing StrategySTART

Solution: Add Alpha to the Pricing StrategySTART

Project SummarySTART

Delivery Policy

When will I receive my course?

You will receive a link to download/view your course immediately or within 1 to 24 hrs. It may takes few minutes, also few hours but never more than 24 hrs. Due to different time zone reasons.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you’ll receive an email with a google drive folder access link to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

Where can I find my course?

Once your order is complete, a link to download/view the course will be sent to your email.