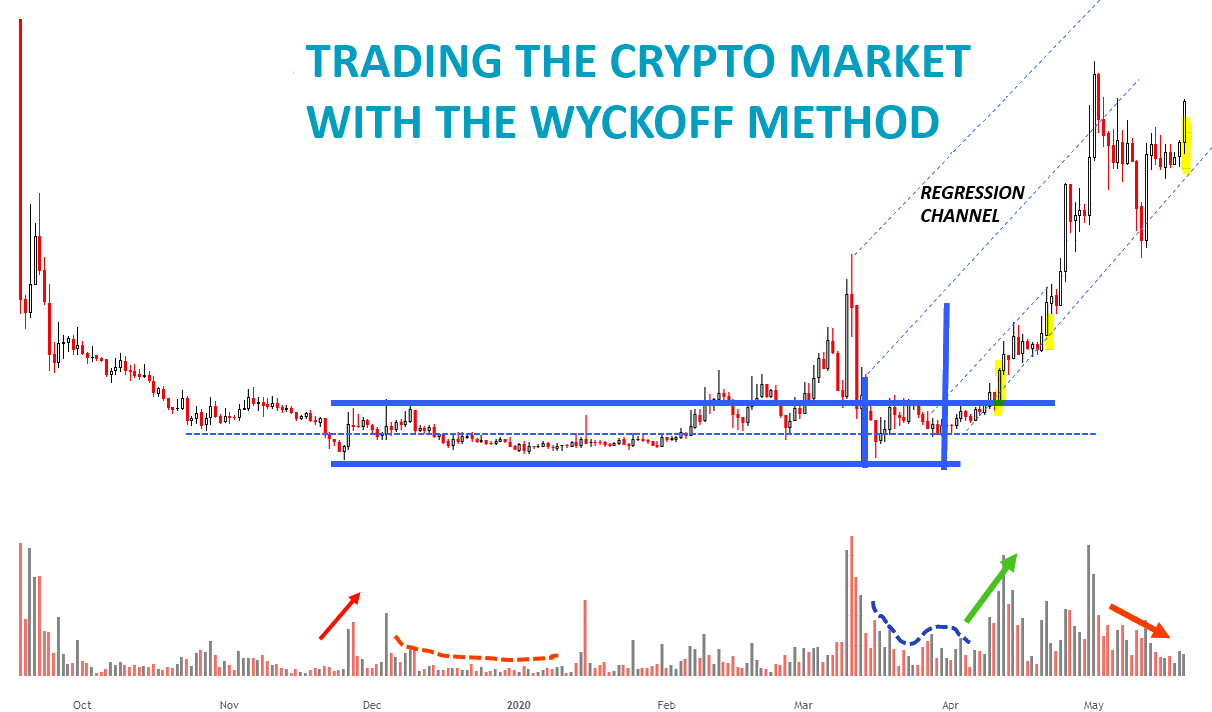

Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method | 4.28 GB

Wyckoff Analytics – Trading the Crypto Market with the Wyckoff Method

Cryptocurrencies are among the most speculative opportunities of the last decade.

Investing and trading in the crypto space requires discipline and a systematic approach. The Wyckoff Method provides a logical framework for both long term investors and intraday traders.

In these three sessions, Alessio Rutigliano will illustrate how to apply the techniques used by generations of stock and commodities traders to this new emerging asset class. The course will cover multiple strategies for several types of traders, from long-term investors that want to participate in this new market through conventional ETNs, to advanced crypto traders that want to take advantage of the high volatility and momentum of these instruments. The course will include case studies from Bitcoin and Altcoin markets and exercises.

Here are the main topics that will be covered throughout the three lessons:

– The Wyckoff Method. From stocks to cryptos. How to read the footsteps of the Composite Operator. Case studies of Cyclical accumulations in Microsoft, Gold, Bitcoin.

– Anatomy of the Crypto Market. Bitcoin and Altcoins. 10 years of market history through price and volume. Cyclical accumulations. The News Cycle in Crypto Markets.

– Tape reading and market participant analysis in a low liquidity environment. How liquidity affects market structure? Price and volume nuances specifically revisited for cryptocurrencies and mid-low caps.

– Relative strength. As is the case with equities funds, crypto funds focus on relative performances, as they search among those assets showing leadership characteristics. The speculative nature of the crypto assets implies a very quick rotation of capital from one asset to another. Wyckoffians have an edge when it comes to spotting the rotation of institutional capital in any market. Learn how to use Comparative analysis to boost your performance.

– Timing. Speculative markets are marked by very dull periods followed by aggressive up moves. What looks like a sport of velocity is actually a long chess game where few moves determine the outcome.

– Point and Figure Charting in Crypto Markets. How to adapt one of the oldest forms of technical analysis to these hi-tech financial instruments.

– Campaigning Crypto assets. Strategies for long term investors and stock traders. Bitcoin ETNs, Grayscale Investment Trusts. Blockchain and Mining Stocks.

– The Altcoin Swing Trader. Trading plan for high momentum cryptos. Strategies for mid and micro-cap crypto assets.

– The Intraday Trader. Trading Bitcoin Perpetual Contracts and Crypto Indexes.