Wyckoff The Stock Market Institute Lecture Series Vault

Wyckoff The Stock Market Institute Lecture Series Vault course is now available at an affordable price. You can check out directly using multiple payment gateway options. If you have any questions or need an alternative payment method, feel free to contact us.

Description

|DOWNLOAD| WYCKOFF THE STOCK MARKET INSTITUTE LECTURE SERIES VAULT

Welcome to the SMI Evans Echoes Lectures. Over the years, the Stock Market Institute has focused its efforts on teaching the Wyckoff Method to over 5 generations of students. While many stock issues have appeared and disappeared (Mr. Wyckoff probably would have been shocked to learn that a stock could be named Google). the Wyckoff methods and principles have remained constant and made many Wyckoff traders very successful.

Table of Contents

Toggle

Welcome to the SMI Evans Echoes Lectures. Over the years, the Stock Market Institute has focused its efforts on teaching the Wyckoff Method to over 5 generations of students. While many stock issues have appeared and disappeared (Mr. Wyckoff probably would have been shocked to learn that a stock could be named Google). the Wyckoff methods and principles have remained constant and made many Wyckoff traders very successful.

The lectures are a great opportunity to brush up on important Wyckoff principles. It’s the little things we tend to forget that seem to yield the nice profits.

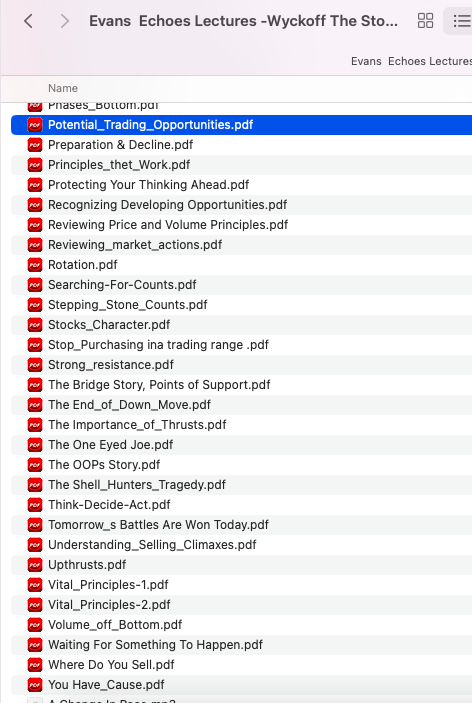

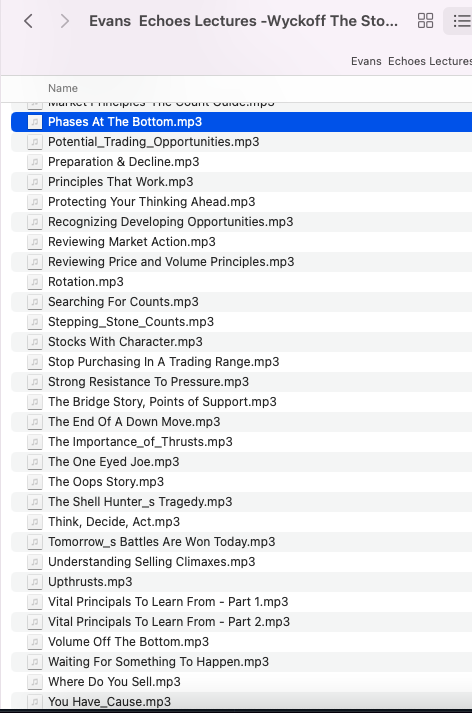

The Evans Echoes lectures are available for download in MP3 format. With a few exceptions, the lectures are accompanied by the related charts, in an Adobe Acrobat format.

To insure quality, these lectures are large files. Depending on your Internet connection can can take several minutes to download the files to your computer. Please be patient.

Wyckoff is explained by the SMI’s great communicator, Robert Evans. Enjoy these wonderful and timeless stories and examples about how you can trade profitably using the Wyckoff methods. Each lecture, unless marked otherwise, includes accompanying charts.

– A Change In Pace– A Study Of Short Selling– A Study Of The Optimism Pessimism Index– Analysis of Optimism Pessimism– Answering Basic Questions– Anticipate What Will Happen After A Climax– Anticipating The End Of A Decline– Anticipation, The Road To Profits– Basic Law Of Cause & Effect– Buy_Ones_Moving– Buying On Climaxes– Confessions Of A Poor Student– Distribution & Decline– Dont_Fight_Current– Effort_vs_ Results– Excellent Examples Of Wyckoff Principles– Good Sound Reasons– Having Problems With Stop Orders– How Stocks Move– How The Principles Of Wyckoff Work– How To Watch A Select Group Of Stocks– Hunting For Bargains– Ice_Story– Importance Of Selling Short– ImportantWords– Interpreting The Intra-day– Justified Sign Of Weakness– Learning From Mistakes– Look For Principles- Not For Bargains– Market Phases– Market Principles-The Count Guide– One Eyed Joe– Phases At The Bottom– Potential_Trading_Opportunities– Preparation & Decline– Principles Of Volume Action– Principles That Work– Protecting Your Thinking Ahead– Recognizing Developing Opportunities– Reviewing Market Action– Reviewing Price and Volume Principles– Rotation– Searching For Counts– Stepping_Stone_Counts– Stocks With Character– Stop Purchasing In A Trading Range– Strong Resistance To Pressure– The End Of A Down Move– The Frog Story– The Importance Of Thrusts– The OOPs Story– The Shell Hunter’s Tragedy– TheBridgeStory– Think-Decide-Act– Tomorrow’s Battles Are Won Today– Trading A Higher Priced Stock– Trading Ranges– Trend Lines– Trend Lines & Counts– Trend Lines-2– Understanding Selling Climaxes– Upthrusts– Vital Principals To Learn From – Part 1– Vital Principals To Learn From – Part 2– Volume Off The Bottom– Waiting For Something To Happen– What To Buy and When– When A Spring Isn’t A Spring– Where Do You Sell– Working With Figure Charts– Wyckoff-Wave-OP-Barometer– You Have To Have A Cause

Click Here View More About: Trading – Forex – Stock – Options

Note:

The lectures are a great opportunity to brush up on important Wyckoff principles. It’s the little things we tend to forget that seem to yield the nice profits.

The Evans Echoes lectures are available for download in MP3 format. With a few exceptions, the lectures are accompanied by the related charts, in an Adobe Acrobat format.

To insure quality, these lectures are large files. Depending on your Internet connection can can take several minutes to download the files to your computer. Please be patient.

Wyckoff is explained by the SMI’s great communicator, Robert Evans. Enjoy these wonderful and timeless stories and examples about how you can trade profitably using the Wyckoff methods. Each lecture, unless marked otherwise, includes accompanying charts.

– A Change In Pace

– A Study Of Short Selling

– A Study Of The Optimism Pessimism Index

– Analysis of Optimism Pessimism

– Answering Basic Questions

– Anticipate What Will Happen After A Climax

– Anticipating The End Of A Decline

– Anticipation, The Road To Profits

– Basic Law Of Cause & Effect

– Buy_Ones_Moving

– Buying On Climaxes

– Confessions Of A Poor Student

– Distribution & Decline

– Dont_Fight_Current

– Effort_vs_ Results

– Excellent Examples Of Wyckoff Principles

– Good Sound Reasons

– Having Problems With Stop Orders

– How Stocks Move

– How The Principles Of Wyckoff Work

– How To Watch A Select Group Of Stocks

– Hunting For Bargains

– Ice_Story

– Importance Of Selling Short

– ImportantWords

– Interpreting The Intra-day

– Justified Sign Of Weakness

– Learning From Mistakes

– Look For Principles- Not For Bargains

– Market Phases

– Market Principles-The Count Guide

– One Eyed Joe

– Phases At The Bottom

– Potential_Trading_Opportunities

– Preparation & Decline

– Principles Of Volume Action

– Principles That Work

– Protecting Your Thinking Ahead

– Recognizing Developing Opportunities

– Reviewing Market Action

– Reviewing Price and Volume Principles

– Rotation

– Searching For Counts

– Stepping_Stone_Counts

– Stocks With Character

– Stop Purchasing In A Trading Range

– Strong Resistance To Pressure

– The End Of A Down Move

– The Frog Story

– The Importance Of Thrusts

– The OOPs Story

– The Shell Hunter’s Tragedy

– TheBridgeStory

– Think-Decide-Act

– Tomorrow’s Battles Are Won Today

– Trading A Higher Priced Stock

– Trading Ranges

– Trend Lines

– Trend Lines & Counts

– Trend Lines-2

– Understanding Selling Climaxes

– Upthrusts

– Vital Principals To Learn From – Part 1

– Vital Principals To Learn From – Part 2

– Volume Off The Bottom

– Waiting For Something To Happen

– What To Buy and When

– When A Spring Isn’t A Spring

– Where Do You Sell

– Working With Figure Charts

– Wyckoff-Wave-OP-Barometer

– You Have To Have A Cause

Click Here View More About: Trading – Forex – Stock – Options

Note:

We will provide a download link include full courses as my description.

Â

Â

Â

Delivery Policy

When will I receive my course?

You will receive a link to download/view your course immediately or within 1 to 24 hrs. It may takes few minutes, also few hours but never more than 24 hrs. Due to different time zone reasons.

How is my course delivered?

We share courses through Google Drive, so once your order is complete, you’ll receive an email with a google drive folder access link to view the course in your email.

To avoid any delay in delivery, please provide a Google mail and enter your email address correctly in the Checkout Page.

In case you submit a wrong email address, please contact us to resend the course to the correct email.

Where can I find my course?

Once your order is complete, a link to download/view the course will be sent to your email.